Rent Is Due!

Use It To Grow Your Credit Score.

$0 Due Today With Code: SMARTPAY5

Instead of paying the $94.95 setup fee, make 3 monthly payments of $31.65 plus the subscription fee of $9.95, once your rent history is verified.

RentCheck enrollment is required within 2 days of sign up to qualify for SmartPay, otherwise the standard $94.95 enrollment fee will be charged.

No Matter How

You Pay Your Rent,

We Can Report It!

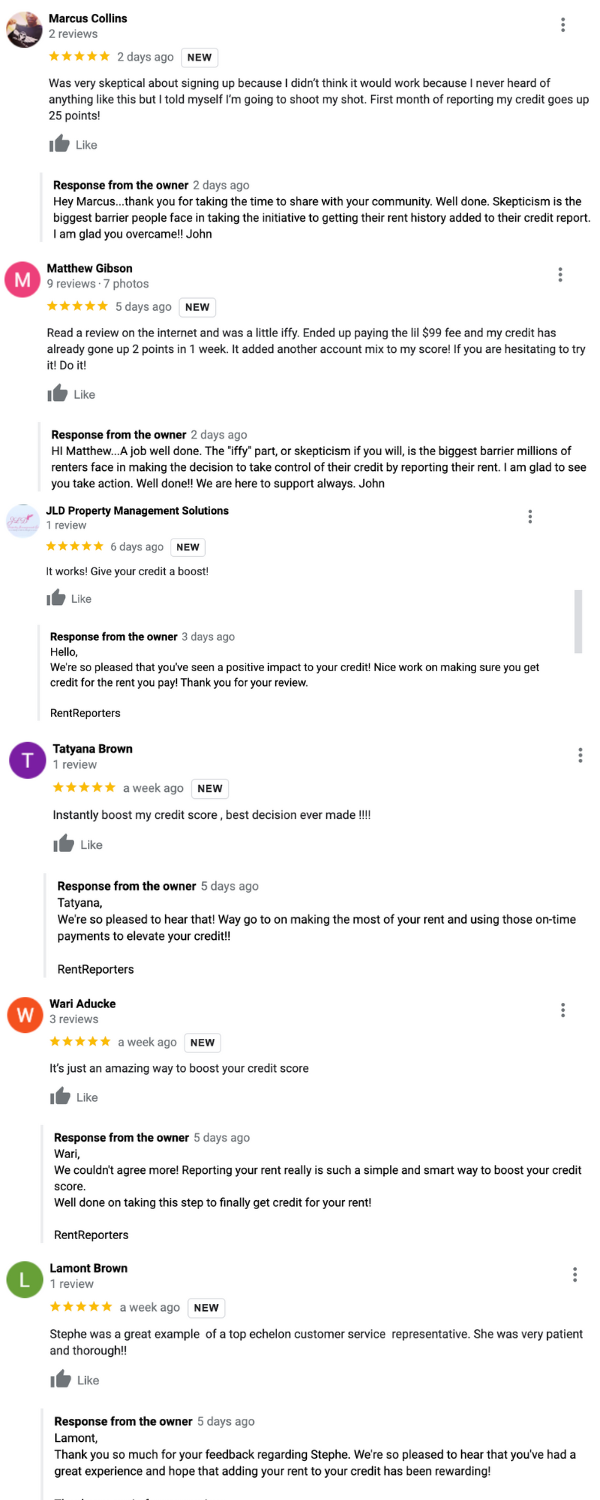

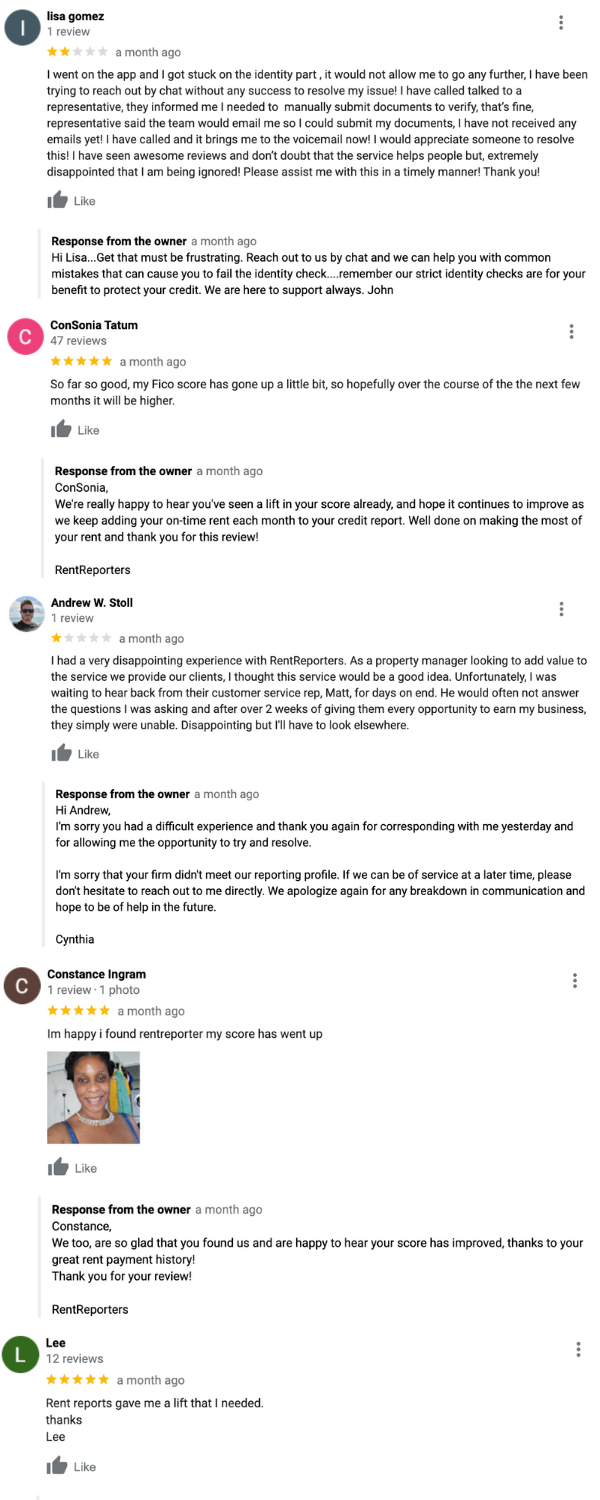

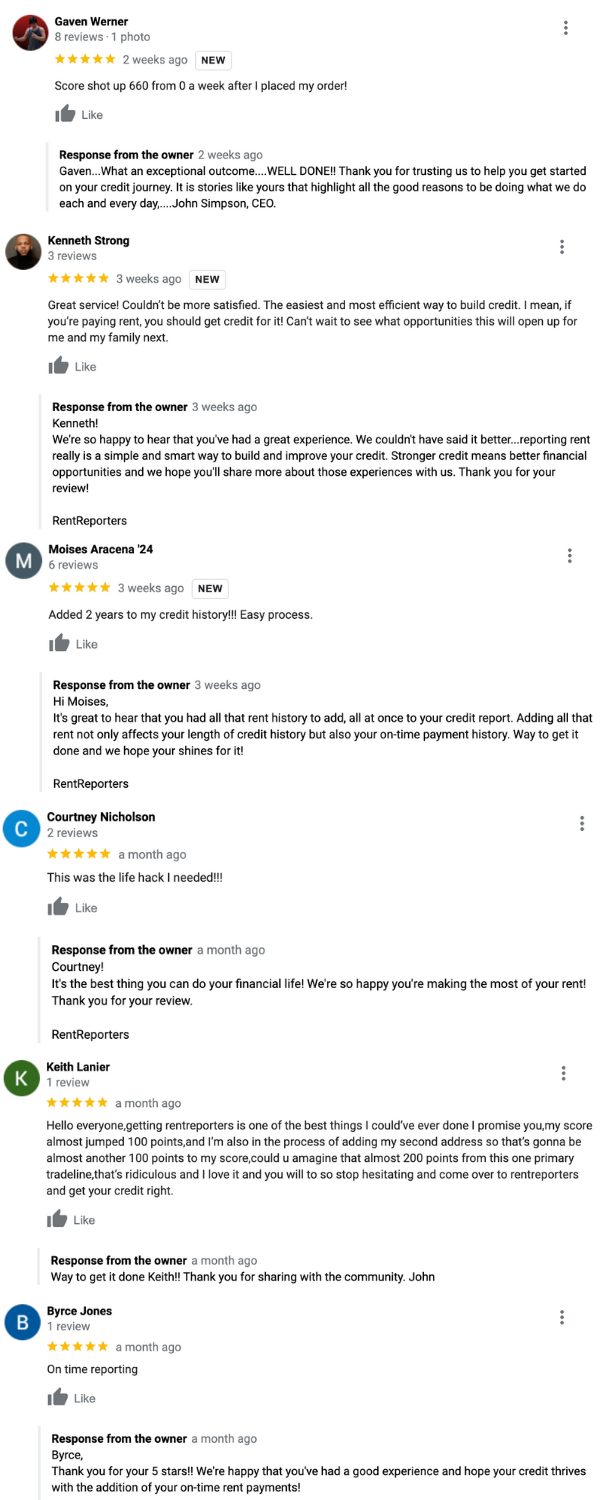

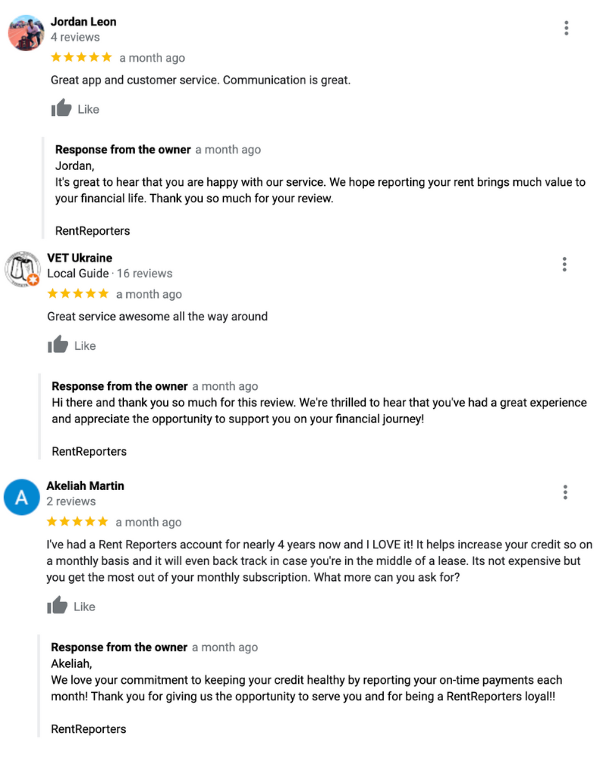

Our Reviews Speak For Themselves

We don't always get it right though, we even included our negative reviews below - hint, there's not many.

Our customers love us for one simple reason: Our service WORKS.

We understand skepticism when struggling financially or with credit - it's easy to feel trapped.

RentReporters is a light at the end of the tunnel.

What is Rent Reporters

Rent is your biggest bill and now it can count toward your credit score.

Reporting your rent adds another line of credit, which the credit bureaus can factor into your monthly score. As long as you’re paying within 30 days of rent being due, that’s an opportunity for credit growth. Many renters have gotten their credit into the 700s and 800s by reporting their rent!

RentReporters helps you qualify for rewards cards to earn more money while you spend.

The best credit cards come with great perks: cash back, rewards points, discounts, and more! To qualify for these cards, you need an excellent credit score. By reporting monthly rent payments, you can build your score and get approved for the credit cards you want.

As a recent college grad, RentReporters allows you to build credit FAST.

Rent reporting is a great way for young adults and recent graduates to build credit and qualify for credit cards, housing, and loans. You can report dorm payments, student housing, and renting from family members! RentReporters can take you from credit invisible to creditworthy.

Rent is your biggest bill and now it can count toward your credit score.

Reporting your rent adds another line of credit, which the credit bureaus can factor into your monthly score. As long as you’re paying within 30 days of rent being due, that’s an opportunity for credit growth. Many renters have gotten their credit into the 700s and 800s by reporting their rent!